Tax Efficiency

Tax efficiency can mean a lot of different things depending on who you ask.

Tax efficiency can mean a lot of different things depending on who you ask.

For financial services firms, tax efficiency might mean enabling advisors to reduce their client’s tax burden. Individual investors without a financial advisor, want their investment portfolios to be tax efficient, too, but often, investors have incomplete information and misaligned strategies. When an advisor finally looks at the individual’s investment accounts, they often have to reorganize and reallocate assets to correct some of the tax efficiency mistakes.

As an advisor, you have the ability to increase tax efficiency across an entire array of investment portfolios, whether clients are looking to maximize retirement income, find the proper allocation for the investments in their portfolios, or make withdrawals or distributions. With efficient planning and management, advisors can add years of runway to a client’s retirement income by minimizing tax liability. If measures are not applied early on in an investor’s journey, when accumulating assets, clients may find when they need to withdraw money for expenses that they’ve left significant retirement income on the table.

Tax-Efficient Strategies Firms Should Consider For Investors

Investors fall on a spectrum. Some know exactly where they want their money (and why), and others don’t have a clue other than they need to invest for retirement. Some people fall in the middle of these two extremes, but advisors help people with unique needs all along the spectrum.

What does this mean for advisors? Advisors need a variety of investment levers they can pull to increase retirement income for their clients at different points in their life. Every client is different, and each client can benefit from a different mix of tax-efficient investing strategies. Arming advisors with the right technology to execute this at scale is the key to gaining a competitive advantage in today’s market.

Contributions to Tax-Efficient Accounts

To help clients get the most out of the investments they are making for the future, advisors need to help their clients allocate funds to the most tax-efficient accounts. These accounts may include traditional IRAs, Roth IRAs, or 401(k) accounts that can help mitigate current and future tax liabilities.

One common account is the traditional individual retirement account (IRA). Contributions to a traditional IRA are typically tax-deductible, so investors can reduce their taxable income by the amount they contribute, up to certain income thresholds. This upfront tax deduction provides an immediate benefit by potentially lowering the client’s current tax bill. However, taxes will be owed upon withdrawal during retirement.

Similarly, traditional 401(k) accounts offer tax advantages. Contributions to a traditional 401(k) are made on a pre-tax basis, which reduces the individual’s taxable income in the year of contribution. The contributions grow tax-deferred until withdrawal, typically during retirement. Like traditional IRAs, taxes are owed upon withdrawal from traditional 401(k) accounts.

Roth 401(k) accounts are funded with post-tax contributions, meaning taxes are paid on the income before it goes into the account. The advantage of a Roth 401(k) is that the growth of the investments within the account is tax-free. This can be particularly beneficial if the investor expects their tax rate to be higher in the future or wants to enjoy tax-free income during retirement.

Advisors can provide personalized recommendations on the optimal allocation of funds across traditional IRAs, Roth IRAs, and 401(k) accounts, considering both current and future tax advantages and factors such as income levels, expected retirement age, and future tax rates. With the right technology at their fingertips, advisors can give these personalized recommendations at a household level. Ultimately, the goal is to assist clients in maximizing the tax efficiency of their investments, allowing them to grow their wealth while minimizing unnecessary tax burdens.

Account Diversification Within the Unified Managed Household

Smart-householding is a strategy that advisors use to look at the investment plan based on the aggregated view of all accounts within a household, which includes portfolios of both a client and a spouse. Advisors will use this method to reduce investment costs, manage portfolio risk, and increase the tax efficiency of a household portfolio.

The mixing and matching of income sources throughout retirement will come from a variety of accounts, Social Security, and pensions. That is why it is important to start coordinating accounts early in an investor’s life. The advantages of tax efficiency are not immediate, but they are significant.

The ultimate goal, when a client begins decumulation, is for the advisor to help draw down funds across these accounts in a way that minimizes the tax burden and increases a client’s runway. Advisors are often required to look at all these accounts to find the best distribution strategy to keep taxes low and maximize retirement income, which is another place tax efficiency comes into play. There is an optimal way to take withdrawals across multiple accounts. Advisors just need the technology to do it.

Make Investments Tax-Efficient From The Start

One effective approach to help clients optimize the tax efficiency of their investments involves considering investments that offer tax benefits right from the start. Municipal bonds, for example, provide tax-exempt earned income, making them an attractive option for clients aiming to enhance their tax situation. By investing in these types of assets early on, clients can proactively plan for the future without compromising their income during retirement.

Municipal bonds are debt securities issued by state and local governments to fund public projects such as infrastructure development, schools, and hospitals. The interest income generated from these bonds is typically exempt from federal income tax. In some cases, the interest may also be exempt from state and local taxes if the client resides in the same state as the issuing municipality. This tax-exempt feature makes municipal bonds particularly beneficial for investors in higher tax brackets, as they can potentially reduce their overall tax liability.

By incorporating municipal bonds into their investment portfolio, clients can generate tax-free income, allowing them to maintain a higher level of cash flow during retirement. This can be especially advantageous for individuals who rely on their investment income to cover their living expenses. The tax-exempt nature of municipal bond earnings helps preserve a larger portion of the income, providing clients with greater financial flexibility and potentially enhancing their overall quality of life in retirement.

Investing in municipal bonds aligns with a long-term investment strategy. These bonds are typically considered low-risk investments, backed by the issuing government’s ability to levy taxes and generate revenue. As a result, they offer a stable income stream and can provide a level of capital preservation. By including municipal bonds in their investment portfolio early on, clients have the opportunity to build a solid foundation of tax-efficient investments that can support their long-term financial goals.

Note: LifeYield is not endorsing an investment strategy completely centered around muni bonds.

Similarly, there are other tax-efficient strategies investors can start with. For example, opening a Roth IRA is one of the most impactful moves a young tax-smart investor can make. If they can also contribute the maximum to this account each year, they will have an amazing head start when it comes to saving for retirement. All the compound growth is tax-free, so the earlier they start putting money into a tax-advantaged account, the better.

Using Asset Location as a Strategy

It is almost impossible to take advantage of a tax-efficient strategy if investors aren’t putting their investments in the right accounts. Asset location works by matching each investment holding with the account that will provide optimal tax treatment. Advisors can use this strategy to help clients reduce their tax exposure and minimize tax drag across. But to wring the most benefit from asset location, advisors must apply it across the entire array of portfolios owned by the household at once. This level of scale – household management – can only be accomplished with LifeYield technology.

When using an asset location strategy, decisions about where to hold the various investments roll up to one overall household allocation. There are many tax advantages to coordinating assets across accounts instead of managing each account separately. The asset location process involves dividing the investment portfolio among different investment accounts to achieve the greatest level of tax efficiency for each client.

Should a Client Hold Investments Longer to Avoid Unnecessary Capital Gains Taxes?

When it comes to managing investments, taxes play a significant role in determining the overall returns. While it’s generally not advisable to hold onto a stock solely to avoid taxes on gains, there are exceptions and considerations to keep in mind. Understanding the tax implications of selling assets can help investors make informed decisions to optimize their tax situation.

When an asset is sold after being held for less than a year, any gain from the sale is classified as a short-term capital gain. Short-term capital gains are taxed at ordinary income tax rates, which means they are subject to the same tax rates as other sources of income, such as wages or salary. The tax rates for short-term gains can vary depending on an individual’s tax bracket, ranging from the lowest tax rate to the highest marginal tax rate applicable to their income level.

On the other hand, assets held for more than a year before being sold fall into the long-term capital gain category. The tax rates for long-term capital gains are typically more favorable compared to short-term gains. The specific tax brackets for long-term gains depend on an individual’s filing status (single, married filing jointly, head of household, etc.) and can change from year to year due to tax law revisions. However, as of 2021, the long-term capital gain tax brackets for single filers were as follows:

- 0% tax rate: For individuals with a total income (including capital gains) of $40,000 or less, their long-term gains are taxed at a 0% rate, meaning they pay no tax on those gains.

- 15% tax rate: Individuals with a total income exceeding $40,000 but not surpassing $441,450 are subject to a 15% tax rate on their long-term capital gains.

- 20% tax rate: For those with an income above $441,450, their long-term capital gains are taxed at a maximum rate of 20%.

Tax rates can change over time, so it’s essential to stay updated with the current tax laws and consult with a tax professional or financial advisor for the most accurate and up-to-date information.

Considering the tax implications of selling investments is crucial for investors looking to optimize their overall tax picture. While it’s generally advisable to make investment decisions based on factors such as portfolio diversification, risk tolerance, and long-term goals, understanding the potential tax consequences is also important. By holding assets for longer than a year and qualifying for long-term capital gain treatment, investors can potentially benefit from the more favorable tax rates associated with those gains.

It’s important to approach tax considerations as part of a comprehensive investment strategy rather than as the sole driving factor. Investors and their advisors should assess their investment goals, time horizon, and risk tolerance, in addition to tax implications, to make informed decisions that align with their overall financial objectives.

Financial advisors can play a vital role in helping clients navigate the complexities of taxes and investments. They provide guidance on tax-efficient investment strategies, recommend appropriate holding periods for assets, and help clients understand the potential impact of taxes on their investment returns. By working closely with an advisor and considering all relevant factors, investors can have a balanced approach that maximizes their after-tax returns while aligning with their individual financial goals.

Use Tax-Loss Harvesting to Offset Gains

One of the best strategies that an advisor can do for clients is tax-loss harvesting to offset the gains made from selling securities. It helps to reduce the taxable income from that sale by selling other securities at a loss. Some specifics should be considered when using this strategy. It is important to avoid wash sales when selling to harvest losses. Advisors need to overcommunicate with clients when they’re executing this to make sure they’re not purchasing a similar stock for a certain period of time. If they do, the wash sale is null-and-void and they will still have to pay taxes on their initial gains. If losses exceed the gains, they can be carried over into future tax years.

Why Are Tax-Efficient Strategies Important?

This question might seem silly to some, but many potential investment management clients have no idea that they could be minimizing their tax liabilities. Unfortunately, some people investing in retirement have no idea that they are jeopardizing their future income amounts just because of the taxes they’re paying or deferring into the future.

Firms can change this and create strategies that are tax-efficient and maximize the rates of return for clients. The best way to help a client structure their investments to reduce their tax liability is by locating funds to the right investment accounts.

Have you ever tried to execute this by hand or in spreadsheets? The results are all over the map. Thes tax minimization strategies described here can only be executed at scale using technology.

It is also important for advisors and their clients to understand the changes that get made to retirement and investment laws. And in recent years, that’s happened twice.

For example, the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 was passed by Congress and took effect for the 2020 fiscal year.

The SECURE Act of 2019 changed the way that traditional IRA contributions can be made. Now investors of any age can make contributions to these accounts and get a tax deduction. There was an age limit for IRA contributions before this was passed, and now there is none.

In previous years, those who waited to take distributions were required to take minimum distributions (RMDs) automatically at age 70 ½. The SECURE Act increased the minimum distribution age to 72, allowing account holders to wait longer before taking the required withdrawals.

Then in 2022, Congress passed SECURE 2.0 with about 90 provisions affecting tax-qualified retirement plans. One of those raised the age for RMDs to 73 starting in 2023 and to 75 in 2033.

So, if you’re going to execute a tax-efficient strategy for each client, you need to stay up to date on tax laws. With applications, like those from LifeYield, updated for tax law changes as they become effective, you’ll never have to worry about misinterpreting a tax law again.

How a Firm’s Advisors Should Approach Their Clients About Tax Efficiency

Money is often a sensitive subject, even when advisors are talking to clients known and worked with for years. But difficult conversations can be easier when approached correctly.

For all clients, taxes are a reality. Many investors avoid discussing taxes until it is time to file for Social Security and take distributions from their portfolios. Unfortunately, many clients don’t realize that it is too late for advisors to come up with a strategy that minimizes taxes at that point. A strategy like this requires investment clients to be proactive with their portfolio and try to maximize tax efficiency BEFORE they approach retirement, not during or after.

Being tax-smart means looking at all of the elements that determine a client’s tax bill, not just earned income. Investment taxes are the single biggest drag on a portfolio’s returns. Setting this investment strategy up early on helps to achieve the best possible outcome for each client, tailored to their individual investment goals.

Why Should Advisors Care About This?

Most clients don’t realize that they are an active part of the tax-efficient investing process. Utilizing strategies that reduce the tax burden and optimize the investment strategy will help produce the best possible investment outcome for clients AND advisors. After all, it’s what is left after taxes that matters most for the client. But more money in the portfolio means more revenue for the advisor. And that’s a win-win.

Clients aren’t the only ones who benefit from tax-efficient portfolio practices – firms and advisors do, too. Advisors who can quantify the benefits being provided to clients are a huge step ahead of their competition. This can be their competitive advantage.

“I can increase your after-tax returns by $150,000 over ten years” is much better than “I’m going to do everything I can to help you avoid investment taxes.” This approach increases the trust between advisor and investor, creating long-lasting relationships.

Keeping Clients Happy with Tax Efficiency and Technology

Tax efficiency and technology go hand-in-hand, especially for advisors. Traditionally the technology that advisors had access to only handled one account at a time, making it almost impossible to efficiently coordinate assets across a household.

The more retirement income an advisor can generate, the happier their investment clients are going to be. If it becomes necessary for a client to make a withdrawal unexpectedly, they would hope that it will be done in the most tax-efficient way and as quickly as possible. There are some circumstances when they can’t wait days or weeks for their advisor to come up with the right strategy for taking a withdrawal. Technology can execute this in seconds.

That is how firms lose not only their top advisors but the clients as well – they don’t have the right strategy for handling expedited requests like these. Additionally, if a new advisor can tell clients they’ll increase their retirement income by over $100,000 just by coordinating their assets, you can bet that clients will jump ship.

How Can a Firm Accommodate Advisor Technology Requests and Keep Clients Happy?

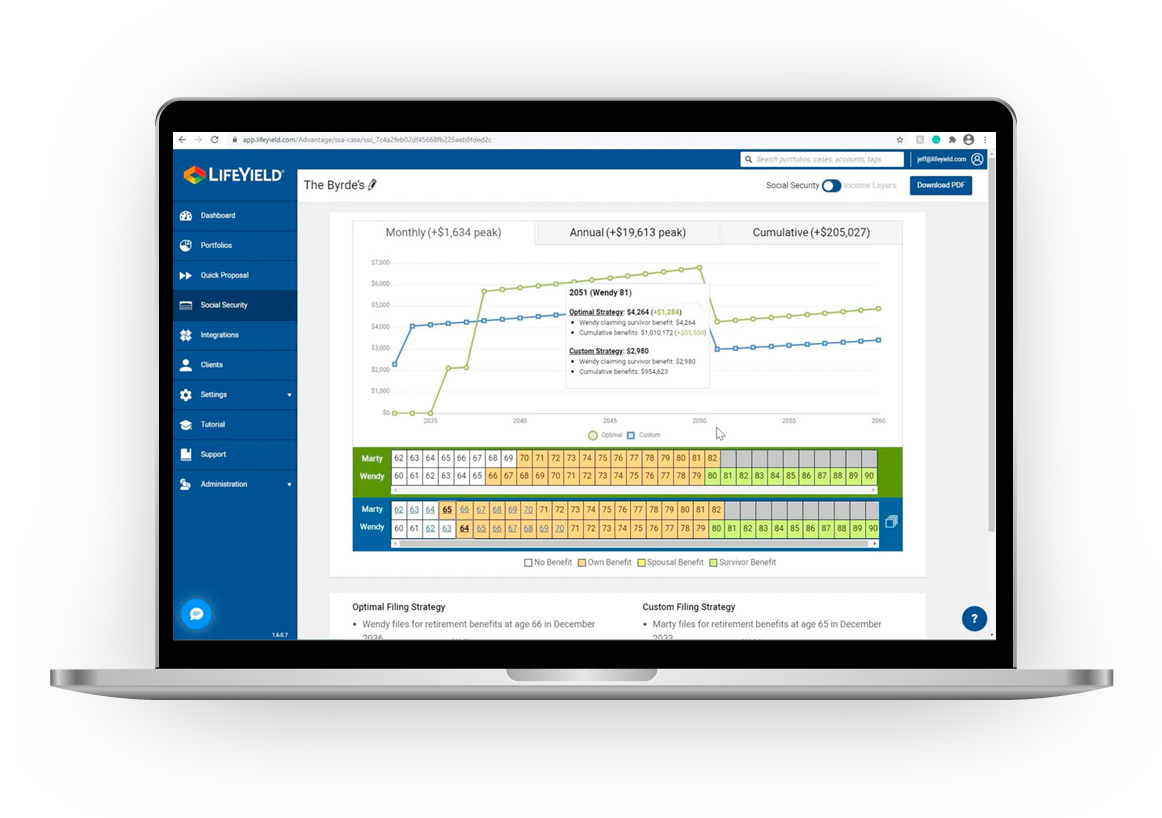

LifeYield is a proprietary technology platform that automates everything tax related for firms and their advisors, making it possible for advisors to handle client portfolios with 0 margin for error. The technology covers a variety of areas, including tax-efficient asset location, multi-account withdrawals, rebalancing, and tax harvesting. When used together, LifeYield APIs help firms take wealth management to the household level.

The Asset Location Score

The Asset Location Score is LifeYield’s personalized approach to quantifying the tax efficiency of an investment client’s household. This score helps advisors take the current household and assign an efficiency score as it stands today. Think of this as a starting point to be able to see the potential increase in efficiency once optimized.

The score ranges from 0 to 100, with 53 being the average score across all portfolios using LifeYield technology. The number is indicative of the tax efficiency of the entire household and provides firms and advisors with a step-by-step blueprint to improve that score.

After running a portfolio through LifeYield’s technology, the Asset Location Score can then be presented to the client, showing the portfolio’s current level of tax efficiency. LifeYield also presents a series of next-best actions that advisors can take to improve the score. These recommendations come with a score improvement and dollar benefit so the client can understand the impact of each step.

The result is an optimal outcome that leads to greater trust between advisor and client, improved client retention rates, asset consolidation, and increased referrals from satisfied clients.

The LifeYield Technology Library

LifeYield changes the way that firms and advisors create a unified managed household, or UMN. Technology that optimizes asset location, makes withdrawals tax-efficient, and maximizes retirement income may seem complicated – but the results are tangible. Clients have more retirement income, advisors build trust and assets under management (AUM), and firms reap the revenue benefits of the entire value chain. It’s a win-win-win in the end.

Asset Location

LifeYield’s asset location technology reduces drag across the household portfolio and quantifies the benefit in dollars. Tax efficiency can be instantly improved thanks to the proprietary algorithm scanning all accounts and pinpointing the tax-smart location for every asset (in seconds).

The asset location score baked into the algorithm enables your firm to measure the household’s current efficiency and gives you a blueprint for improving it.

The best part? Asset location can be implemented without replacing your firm’s current technology. LifeYield can run alongside it, enhancing the experience without costly changes to the existing tech stack.

Multi-Account Rebalancing

Traditional rebalancing looks at each account within a portfolio individually. LifeYield makes it possible to rebalance at the household level, which has not been possible until now. Especially after taking a withdrawal, many advisors and clients can benefit from automatically rebalancing a portfolio while minimizing drift from the household allocation.

After the withdrawal has been executed, there will often be some drift and a rebalance will be necessary. Rebalancing in this situation is complex and intricate. You want it to be tax-efficient, you want to make sure to avoid wash sales, and you want to look for opportunities to harvest losses – all at the same time.

That’s where LifeYield’s rebalancing technology is unique. It makes all of this possible at scale.

Tax-Smart Withdrawals

When your firm manages a household, one of the hardest tasks is to make sure that all opportunities for tax efficiency have been found. There are often many different variables, and traditional technologies can only handle one account at a time.

LifeYield’s proprietary engine makes it possible to look at all the assets within the household and identify which lots are the most tax-efficient for a withdrawal and how the portfolio should be rebalanced, if necessary. One API covers multiple aspects of the tax efficiency challenge.

With LifeYield guiding these withdrawals, you can maximize your client’s return, minimize the tax liability of the transaction, and ensure the portfolio stays in line with the target allocation.

Tax Harvesting

The tax harvesting opportunities can go in either direction – losses and gains – depending on the client’s situation. In most circumstances, losses are harvested to help offset client gains for tax purposes. LifeYield makes it possible for your firm’s advisors to scan all accounts within the household (taxable and non-taxable), looking for optimal harvesting opportunities. LifeYield also helps to avoid wash sales using this technology.

LifeYield makes it possible for tax harvesting to be implemented at the household level. Now advisors have a solution that automates the process and makes it easier to harvest gains and losses almost instantly. Tax harvesting is baked into all of the LifeYield Tax Efficiency API logic, making it the most complete solution on the market.

Working Across the Unified Managed Household

The unified managed household strategy provides an aggregated view of the assets within a household. The goal is to look at all the assets at once, not individually. The industry is now making it apparent that advisors need to be focusing on and delivering a holistic, customized approach to help clients reach their goals. Comprehensive and coordinated platforms include the following:

- Customer Relationship Management (CRM) Systems – Allowing advisors to segment the books, position the most relevant offerings to the client and personalize and target offerings for specific clients.

- Financial Planning Applications – Providing comprehensive financial and tax advice across multiple areas, including investments, insurance, and lending solutions that consider the client’s assets, liabilities, and potential earnings.

- Holistic Risk Management – Supporting clients and connecting their overall investment goals with the way they view their world, leading to better investor outcomes.

- Tax Optimization – Tax optimization practices across multiple accounts and products to ensure that tax-smart asset location has taken place.

- Account Data Aggregation – Unifying all the holdings within a household that are held by various custodians.

- Optimal Income Sourcing – Income sourcing and sequencing from multiple accounts, products, and other income sources such as Social Security, pensions, Roth IRA, 401(k), and other tax-exempt accounts.

Why LifeYield For Tax-Efficiency?

LifeYield has been battle-tested by some of the biggest names in the financial industry. These include Allianz, Merrill, Morgan Stanley, Jackson, Personal Capital (now Empower), and more. The technology provides firms and advisors the ability to view and manage multi-account portfolios and recommend the strategies that will best improve the after-tax return for the client.

The purpose of LifeYield technology is to help firms create and execute on the promise of a unified managed household for investors. With Social Security barely functioning as a baseline for most retirees, investors need to build wealth throughout their lifetime. The best way to do this is to maximize the efficiency of what they already have. LifeYield technology helps to enhance the existing software platforms at the largest firms in the world, add tax efficiency as their competitive advantage, and quantify the benefits of this strategy for all their clients.

A unified managed household is no longer a pipe dream. With LifeYield, it’s a reality.